This post was originally published on this site

https://www.theconstructionindex.co.uk/assets/news_articles/2025/07/1753860766_tqreport-mockup3.jpgPlanning applications for new homes in England increased by nearly a third in the second quarter of 2025, compared to the same period in 2024.

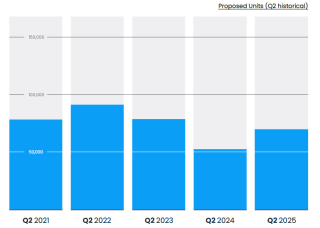

The figures are revealed in the latest Planning Portal Application Index for Q2 2025, which covers 95% of the planning applications made to local authorities in England. The report shows 69,597 new homes were applied for during Q2, up from 52,282 during the same period a year earlier.

Seven out of eight regions saw more new homes applied for in Q2 of 2025 than in Q2 of 2024, with the West Midlands seeing especially strong growth of 71.7%.

As the chart below shows, applications are still below what was seen in 2021, 2022 and 2023 – Q2 2024 was particularly bad, in the run up to the general election.

Geoff Keal, chief executive of TerraQuest, which runs Planning Portal, said: “There are clear signs of sector recovery, with our data revealing a notable rise in planning activity, contrasting with some of the less positive trends reported further along the development cycle, such as in construction. Because our data captures the very first step in the planning journey – often months before work begins on site – it provides a reliable early indicator of market sentiment. The recent uplift points to growing confidence among developers and housebuilders, likely driven by positive policy signals, including the revised National Planning Policy Framework (NPPF) and the Planning & Infrastructure Bill currently progressing through the House of Lords.

“While the figures don’t yet align with the government’s target of 1.5 million homes, they do show a clear uptick in the planning pipeline. This growth signals renewed market intent, as the sector lays foundations for increased activity while planning reforms take time to bed in.”

Mary-Jane O’Neill, head of planning consultancy (London & south) at Lambert Smith Hampton, said: “We’re seeing an increase in planning and housing applications, especially in areas where local plans are under review or recently withdrawn. The December 2024 updates to the NPPF, including a softer housing delivery test and clearer support for brownfield development, have encouraged more speculative and strategic submissions. Developers also appear to be acting ahead of possible policy tightening in late 2025.

There may also be pent-up demand following a subdued period post-covid and earlier plan-making uncertainty. The revised NPPF’s more flexible approach to the five-year housing land supply has lowered risks for developers, making it more attractive to bring forward sites now.”

She continued: “We’re noticing more pre-application engagement and design-led discussions, a positive sign of confidence. However, delivery remains patchy, with build-to-rent and strategic land sectors most responsive, particularly in urban extensions and regeneration areas with existing infrastructure.

“Persistent challenges include delays in signing S106 agreements, nutrient and water neutrality requirements causing local delays, capacity issues within planning authorities slowing determinations, and infrastructure funding gaps limiting readiness.

“While some issues like nutrient neutrality delays are easing due to new mitigation strategies, new challenges have arisen from mandatory biodiversity net gain requirements and the Building Safety Act/Gateway process — both positive in principle but currently adding uncertainty, longer programmes, and increased costs.”

Got a story? Email [email protected]