This post was originally published on this site

https://www.theconstructionindex.co.uk/assets/news_articles/2025/08/1756223329_top-100-image.jpgDespite ongoing concerns over economic fragility, geopolitical upheavals and even the legacy of Brexit, the financial health of the UK’s 100 leading construction firms appears to be improving. The challenges that remain are real, however, and in particular, the spectre of project delays is already looming.

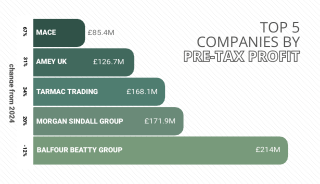

This year’s review of the Top 100 UK contractors is based on an analysis of the companies’ financial results filed up until the end of June 2025. A cursory glance at the main runners and riders reveals few surprises: Balfour Beatty returns to its customary number one position (having been elbowed into second place by Morgan Sindall last year) and the usual suspects – Kier, Wates, Laing O’Rourke, Mace etc – are still clustered at the top of the table.

Top 100 Construction Companies 2025 (click here to see full table)

(**Data compiled by Company Watch)

One very obvious difference, though, is the absence of ISG, the industry’s most high-profile failure of 2024. Last year ISG came in at number four on the Top 100 table.

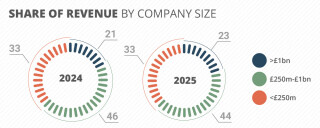

ISG apart, a glance at the table this year shows an overall improvement in the financial performance of the Top 100. Aggregate turnover reached £76.5bn, up by 7.3% compared to the Top 100’s results in the preceding financial year. And the overall bottom line is also strengthening.

Aggregate profits in the latest Top 100 surged 57% to just over £1.9bn as contractors acknowledged the old business adage of ‘turnover is vanity, but profit is sanity’.

Turnover grew at 69 of the Top 100 companies – down from 78 last year – but pre-tax profits increased at 68 companies this year, up from 51 in 2024. As a result, margins – calculated as profit divided by turnover – increased.

The average pre-tax margin across the Top 100 rose to 2.4% from 1.9% for the same cohort in the preceding year.

Cumbrian contractor and aggregates group Thomas Armstrong recorded the best pre-tax margin, a very healthy 14.7%, ahead of HW Martin on 12.2%. Three other construction businesses – precast concrete specialist FP McCann, fit-out contractor Axis Europe and drywall specialist Stanmore – all also had profit margins in double digits. But 43 companies in this year’s Top 100 reported a pre-tax margin of less than 2% with 16 of those in negative territory.

Top 100 Construction Companies 2025 (click here to see full table)

Operating margins can often give a better idea of the true level of profitability as this measure comes before exceptional items, such as financial hits due to the cost of projects over-running or supply chain failures.

For operating profits, the same three contractors lead the way – Thomas Armstrong (13.4%), HW Martin (11.2%) and FP McCann (10.8%) – with Henry Boot, which also has a large development operation, in fourth with a margin of 10.4%.

The number of contractors in the Top 100 with an operating margin in double digits has doubled to six from three in the previous year and 54 companies recorded an operating margin of more than 2%, up from 40 a year earlier. This raw data also suggests an increasingly healthy-looking industry.

The number of companies showing signs of financial weakness has decreased according to Company Watch, the financial analytics specialist that produced the latest Top 100 for The Construction Index. But signs are emerging that delays in project starts are beginning to have an impact across a sector that expected the very opposite following a change in government last year.

“As with any industry, uncertainty drives a lack of investment and with a Labour government, we expected the tap to be turned on,” says James MacKenzie, chief financial officer at Willmott Dixon (ranked 18 by turnover and 13 by profitability in the latest Top 100).

“No matter how many announcements are made, the money is not trickling down,” he adds.

Lack of public funding is one cause of slowing opportunities, but an increase in the regulatory burden before work can start on site is also causing problems, notably the new Gateway 2 checkpoint for high-rise buildings introduced with the Building Safety Act.

There are now three specific stop/go decision points, or gateways, on the path to building a multi-storey ‘high-risk’ block: Gateway 1 at the planning application stage, Gateway 2 at the design stage and before building work starts and Gateway 3 at completion.

Gateway 2 has proved an obstinate bottleneck. A swathe of applications was passed to the Building Safety Regulator (BSR) last autumn but despite its pledge to clear a growing logjam, figures released in April showed that two thirds of that backlog had not been cleared and dozens of high-rise residential projects remain stalled.

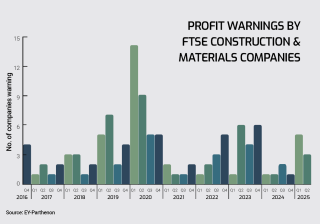

The financial impact of these growing regulatory delays is evident elsewhere. Research by consultant EY-Parthenon shows that warnings of lower-than-expected profits by construction companies on the stock exchange surged in the first half of this year. “Regulatory complexity, particularly from the Building Safety Act, continues to slow approvals,” observes EY-Parthenon.

Willmott Dixon’s James MacKenzie adds: “Regulations can cause delays and that creates costs. [Gateway 2] was never set up properly in the first instance, it’s not got the resources and has not been structured properly. We expect six months to get anything through Gateway 2 and things like that are putting too many pressures on contractors.

“We are having to jump through too many hoops and getting on site is taking longer and longer. The design process is taking longer – there are ways through that – but it’s the indecision of where funding is coming from, particularly for us working in the public sector.”

The government announced a restructuring of the BSR in June in a bid to address the bottlenecks. The success of this remains to be seen.

Funders of private commercial construction have also been slow to give the green light to work during the first half of this year.

Alastair Stewart, a veteran analyst covering construction for Progressive Equity Research, says: “Just now there’s a lot of uncertainty among the commercial clients; anything that’s dependant on long term cash flow. Institutional investors are getting worried about how slow interest rates are to come down; there’s a lot of sitting on hands.”

Economic uncertainty and delays cause frustration for the tier one contractors, but it is their supply chain that is hardest hit.

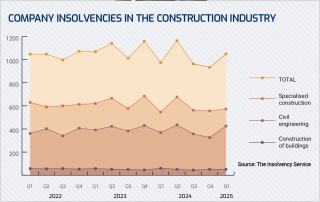

The construction industry continues to suffer more insolvencies than any other sector according to The Insolvency Service and the latest Top 100 suggests specialist contractors (many of whom appear to be prioritising revenue ahead of profits) are among the most vulnerable.

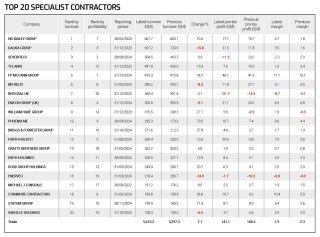

A year ago, there were 15 specialist contractors in the TCI Top 100. This year, that number has risen to 18.

The 20 biggest specialist contractors grew aggregate turnover by 7.1% to nearly £5.7bn, but total profits for this group fell 16.3% to £141.1m and the average pre-tax profit margin shrank to 1.9% from 2.3% across the same companies a year earlier.

Research by Company Watch suggests that specialist contractors at the front end of projects – those delivering demolition, earthmoving and ground engineering services – are growing stronger. Company Watch argues that this is a positive indicator but at the moment specialist contractors that rely on work starting on site are more exposed to the risk of insolvency.

Among those specialist contractors to go under during the past 12 months are cladding outfit Alucraft, scaffolder Rodells, mechanical & electrical contractors TNA and JS Wright and concrete supplier Ever Readymix Concrete & Screed.

Main contractors are also suffering – notably ISG of course – and plenty of smaller firms, such as Surrey-based shed specialist Marbank, have also departed as delays take their toll.

As an industry with historically small profit margins and a higher risk profile than many other sectors of the economy, banks remain sceptical about lending to construction companies. Even the largest main contractors have to pass on some of the financial pressure caused by work stalling.

Willmott Dixon’s James Mackenzie adds: “The financial pressures are felt by the main contractors. Companies like Willmott Dixon with a lot of public sector work have to pass on some of that pressure.

“Construction is generally an unloved sector for the banks. It’s gradually coming back but we need to create an environment where it’s easy to build.”

That environment is not changing any time soon. A rise in profit warnings during the first half of 2025 has continued into Q3 with house-builder Barratt and materials groups Breedon, Grafton and Marshalls all cautioning about lower-than-expected earnings. Weak market conditions was a recurring theme and there are signs of a division between contractors.

Alastair Stewart adds: “The quoted guys seem to be trundling along OK. Most of the big quoted guys have strong balance sheets, not just cash but assets and that’s drawing clients to them. Galliford Try and Morgan Sindall in particular have strong balance sheets. There’s more of a two-tier market developing.”

Contractors with stronger balance sheets will be better able to withstand delays and remain more selective about work as better times begin to materialise. And in some sectors, the short-term prospects remain strong.

Stewart adds: “There is still work out there in data centres and defence. Some of the developers of big industrial hubs went quiet after Liz Truss [and the mini budget in 2023] but that’s also improving.

“Also, anything to do with power distribution as that’s incredibly important with data centres sucking up all the energy. Water is also important as data centres are not just sucking up power but water as well.”

That is good news for the industry. Looking forward, contractors would be well advised to remember another old financial adage – ‘cash is king’ – while waiting for work in other sectors to slowly trickle through.

Insolvencies

The construction industry has the unenviable reputation of being the UK business sector with the highest level of insolvencies. And this year’s data indicates that construction is maintaining that dubious distinction.

In the 12 months to May 2025, the construction industry suffered the highest number of insolvencies across all sectors according to figures from the Insolvency Service.

There were 4,056 company insolvencies in this period, which represents 17% of insolvencies across all sectors.

With recent geopolitical upheavals set against challenging business conditions, this is only to be expected, says Fintan Wolohan, managing associate at international law firm Womble Bond Dickinson: “From a construction industry perspective, the latest statistics come as little surprise.

“The sector has perennially topped the charts for over a decade, reflecting an incredibly tough last few years for construction and the trail of hurdles the industry has had to overcome, including Brexit, the covid-19 pandemic, the war in Ukraine, material and labour supply issues, steep rises in the cost of materials, wage inflation and increasingly extreme weather conditions – to name but a few.”

The latest 12-month total for insolvencies is down slightly on the preceding 12 months, reflecting a wider trend, but the monthly figures show that insolvencies leapt in May 2025, particularly in civil engineering.

Insolvencies among civil engineering firms more than doubled in May 2025 to reach their highest level since February 2024. Meanwhile, the number of building contractors going under was at its highest in more than three and a half years.

Specialist contractors continue to be the most vulnerable of all construction firms: more than half of all construction insolvencies in the first quarter of this year were specialists.

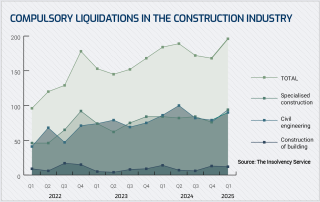

Compulsory liquidations also surged in the first quarter of this year and were 104% higher than in the first quarter of 2022. Building contractors and specialists continue to take the brunt with liquidations more than doubling over that period.

“The monthly average of compulsory liquidations has continued to gradually increase following covid-related restrictions on the use of statutory demands,” adds Wolohan.

In addition to the Brexit/covid/Ukraine effect, rising costs and shortage of materials and manpower, UK construction firms are now struggling with a number of additional challenges that threaten a rising tide of insolvencies.

The increase in employers’ National Insurance contributions and the national minimum wage add to the cost burden while regulatory pressures, subdued activity and project delays contribute to the obstacles companies need to overcome.

Longer term prospects are somewhat more positive, particularly if government promises to invest in residential and civil engineering projects bear fruit.

But even this could pose a challenge, particularly for those specialist contractors that are already exposed to a higher risk of insolvency.

Kelly Boorman, national head of construction at financial consultant RMK UK, said: “The government’s latest push to accelerate delivery of housing and infrastructure projects could leave construction businesses in a difficult position.

“While it’s encouraging to see house-building and infrastructure recognised as drivers of economic growth, there’s the risk of businesses falling into an overtrading trap and taking on more work than their supply chains and operational capacity can support.

“Although pipelines are strong and margins are improving, the supply chain is struggling to keep pace with labour constraints, rising employment costs and future supply shortages anticipated for materials which will drive prices up adding further tension.”

**Company Watch

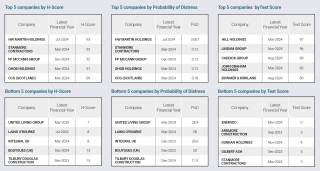

The financial health of the UK’s construction sector has strengthened according to exclusive analysis by Company Watch.

Company Watch uses published financial results to analyse a company’s financial position from a number of angles including profit management, working capital management, liquidity and how assets are funded.

Results are based on how closely the accounts resemble those of companies that subsequently failed. From this, Company Watch’s algorithm determines an H-score (as in Health). Any company with a score of 25 or below is placed in what Company Watch calls the ‘warning area’.

A dozen companies in the latest TCI Top 100 are in Company Watch’s warning area, down from 13 last year.

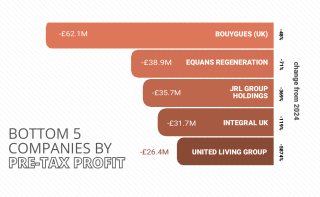

Laing O’Rourke had the worst H-Score last year and is still second to bottom in the latest table after again trading in the red, behind United Living which posted a pre-tax loss of £26.4m in 2024.

Company Watch chief executive Craig Evans’ assessment of the overall picture is fairly positive: “The UK construction sector is exhibiting renewed financial strength, underscored by standout performance in the demolition segment,” he says.

“The latest TCI Top 100 reveals that total revenues have climbed 7.3% to £76.6bn — an encouraging indicator of sustained demand and operational resilience.

“More striking, however, is the 57% surge in profit before tax, reaching £2.3bn, highlighting not just growth but also a marked improvement in margin efficiency and commercial discipline.

“While broader economic headwinds persist, the sector’s positive trajectory implies a recalibration, where disciplined cost control meets strategic investment. For stakeholders – be they investors, suppliers or regulators – these figures point to a sector not just recovering but realigning for future opportunity.”

Company Watch’s analysis also covers two other key areas of financial performance, Probability of Distress (PoD) and Text Score, which can be used to gauge the industry’s financial health.

The PoD ratio is used for bad debt provisioning and gives the percentage probability that a distress event, such as a business failure, reconstruction or acute financial distress, will occur within three years. (A high PoD score, counter-intuitively, indicates a low probability of distress.)

United Living, in addition to its H-Score, also fares worst in this ranking, while Derbyshire-based infrastructure group HW Martin comes out on top in both PoD and Text Score rating.

The Text Score assessment uses advanced machine learning techniques to analyse the text in financial reports of active companies to predict the probability of corporate distress. Similarities in the language or pattern of words to that used by companies that subsequently failed means the company in question could also be at risk of failing, according to Company Watch’s analysis.

Hill Holdings and East Anglian-based Lindum, the two best by Text Score a year ago, also rate the strongest this year while specialist contractor Enerveo again fares worst for a second year in a row.

In addition to showing an industry that is largely strengthening in financial terms, the latest analysis from Company Watch also offers some pointers towards a much-anticipated upturn with companies offering demolition, such as HW Martin and Erith, faring well.

“Demolition — a critical early-stage activity in the construction lifecycle — has emerged as a key barometer of sector health,” adds Evans. “Its robust growth reflects developers’ forward-looking confidence and signals a pipeline of future development across both commercial and residential markets. This uptick suggests capital is being deployed with greater conviction, and risk appetite is returning, particularly in urban regeneration and infrastructure renewal.

“The strength in demolition is more than noise; it’s the sound of foundations being laid for the next cycle of UK construction growth,” he says.

With the latest Top 100 showing growth in overall turnover and profits and Company Watch’s ratings also providing positive indicators, the industry will hope the onset of that cycle is imminent.

Profit warnings

The number of companies quoted on the UK stock exchange warning of reduced profits quadrupled in the first half of this year as delays caused by economic uncertainty took their toll.

In the first half of this year, eight profit warnings were issued by companies in the FTSE Construction & Materials sector compared to just two in the first six months of last year, according to research from EY-Parthenon.

“Warnings citing order cancellations and delays remained elevated at record levels,” says Jo Robinson, head of UK & Ireland turnaround and restructuring strategy at EY-Parthenon.

Across all the sectors studied, the FTSE Construction & Materials lies third behind support services and software for total profit warnings this year.

The three warnings in Q2 follow a surge in the first quarter of the year, when five warnings were issued by construction companies.

Project delays and a weak market were behind piling specialist Van Elle’s announcement in March that profits were expected to fall. This prompted the company to start a review of its Canadian operations culminating in a decision last month to quit Canada altogether.

Four out of the five warnings in Q1 cited delays in contract starts and project timelines and the overall total for Q1 2025 equalled the total for the whole of the previous calendar year.

“In 2024, the sector saw recovery supported by repair and maintenance demand, easing costs, and infrastructure investment,” said EY-Parthenon. “These gains have been eroded by renewed cost and demand pressures in 2025, exposing persistent structural weaknesses.

“Delays are the dominant theme in recent warnings. Three-quarters cited slippage in contract starts and project timelines, which disrupt delivery and strain working capital. Over the past 12 months, some companies have warned that profits will suffer then had to revise those expectations down even further.”

The companies in the FTSE Construction & Materials sector warning of reduced profits are getting bigger, too. The average turnover of companies warning in 2025 is nearly £400m compared to around £300m in 2004 and £200m in 2003.

Among companies in the FTSE Construction & Materials sector warning on profits were builders merchant Travis Perkins, which in April referred to an “uncertain” recovery in the construction market.

In March, a profit warning from structural steel giant Severfield blamed continued project delays, cancellations and a reduced order book. This was its second warning in four months, with pricing pressures having been cited in November 2024.

Outside of the Construction & Materials sector, house-builders Vistry and Gleeson have been forced to lower City expectations. Between October and December 2024 Vistry issued three separate profit warnings on the back of costing errors while in June this year Gleeson cautioned that profits could be up to 20% lower than expected due to slow market recovery and the collapse of a land sale in Yorkshire.

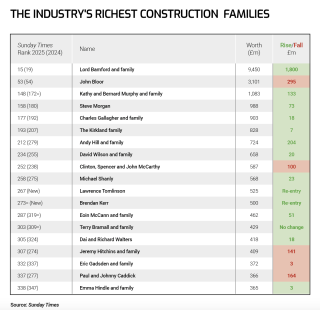

The Construction Rich List 2025

The ability of the construction industry to spawn dynasties of super-rich contractors and developers has weakened slightly, according to the most popular touchstone of personal wealth: the annual Sunday Times Rich List, published in May.

The number of families with fortunes derived from construction-related activities appearing among the 350 members of the Rich List leaped by a third last year to 21. This year the number has slipped back to 19.

One thing that has not changed is the Bamford family’s status as construction’s wealthiest family.

Two years ago, Lord Bamford and his family, owners of construction equipment giant JCB, were ranked outside the top 30. Last year they rose to 19th on the list and today they are the 15th richest family in the country after their fortune ballooned by £1.8bn. The Bamfords are now reckoned to be worth £9.45bn.

Hence the Bamfords remain the only construction clan in the Top 50. But you could argue that JCB barely qualifies as a construction-based business: it’s a manufacturer, and of agricultural machinery as well as construction plant.

So if you were to disqualify JCB on that basis, the UK’s richest construction industry figure would be John Bloor who owns the house-building firm that bears his name as well as the Triumph motorcycle manufacturer.

But while the Bamfords get richer, Bloor is getting poorer. His wealth fell this year for a second consecutive year, dropping by £295m to less than £3.1bn. Nevertheless, with other members of the Rich List losing more, the Bloor family actually edged up one place to 53rd in this year’s list.

Last year, the Bamfords and Bloors were the only construction-related families inside the Top 150, but now the Murphy family (owner of J Murphy & Sons) has edged into that echelon after its wealth rose by £133m to £1.1bn. The Murphys therefore rose from 172nd to 148th place on the list.

Redrow founder Steve Morgan – ranked 220 two years ago – is close to joining the Top 150 as his fortune continues to grow. He’s now worth £988m, putting him at number 155 on the Rich List. The Gallagher family that owns house-builder Abbey is also in the Top 200 (at number 177 with a fortune of £902m).

Behind the Gallaghers is one of the richest contracting households, the Kirklands, with a fortune of £828m. The wealth of the founders of Bowmer & Kirkland only edged up £7m this year, but that was enough to leapfrog by 15 places on the Rich List to 193rd.

Elsewhere, Lawrence Tomlinson, the man behind LNT Homes, re-enters the list at number 267 and Keltbray boss Brendan Kerr returns at 273rd place with a value of £500m.

Andy Hill from Hill Group edge up the rankings after their wealth grew over the past year. Hill is now at 212th place with £724m and Shanly’s £568m wealth takes him to 258th.

Meanwhile Dai and Richard Walters, owners of the eponymous south-Wales based earthmoving contractor, are up 19 places to 305th place with a fortune valued at £418m.

Paul Caddick from the contracting and development group that bears his name is £167m poorer according to the Sunday Times. Caddick just about retains his place on the Rich List, at number 337, but after debuting in 2024, John Kelly (of MV Kelly) and the Wates family both slip out, perhaps reflecting the challenges facing contracting businesses.

Got a story? Email [email protected]